capital gains tax changes 2021 uk

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. The change to capital gains tax went live when the budget was announced on 27th October 2021 and relates to property sales.

What Are The Best Places In The Uk To Invest In Property The Property Talk Rwinvest In 2021 Investment Property Investing Best Way To Invest

Capital Gains Tax.

. Impact on capital gains tax. The CGT rate is currently 20 28 for disposal of residential property or carried interest. Once again no change to CGT rates was announced which actually came as no surprise.

Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the. We were anticipating changes to the Capital Gains Tax CGT rates due to the Office of Tax Simplification report from last year so it was good news to hear that the regime remains unchanged. 25 June 2021.

Changes to the annual exempt amount for Capital Gains Tax for the tax year 2020 to 2021. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. April 2022 Law Stated At.

45 on assets and property. In December 2020 the Wealth Tax Commission presented their report on proposed changes to the current tax laws. However Amy will only pay 20 on the first 37400 of her gain and 40 on the remainder.

The CGT rate is currently 20 28 for disposal of residential property or carried interest. Now that window has increased to 60 days. Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways.

The Office of Tax Simplification OTS has made a range of additional suggestions to the government including an extension of the time allowed to make the payment. In other words the first 24600 of profit you can get tax-free. The measure will bring around 25000 individuals into the scope of capital gains tax in 2021 to 2022.

Any gain over that amount is taxed at what appears to be particularly favourable rates with basic rate taxpayers paying tax at 10 or 18 on residential property and high or higher rate taxpayers only incurring tax at 20 28 on your gains from. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due. At present CGT stands at 20 28 if you are selling taxable residential property but further reliefs have been available to knock.

Changes to the annual exempt amount for Capital Gains Tax for the tax year 2020 to 2021 Non-resident Capital Gains for land and property in. 10 on assets 18 on property. UK Tax Quarterly Update May 2021.

Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four. Non-resident Capital Gains for land and property in. It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March.

This is the amount of profit you can make from an asset this tax year before any tax is payable. 40 on assets and property. If you own a property with a partner you both get that personal capital gains tax allowance.

Capital Gains Tax UK changes are coming. John Hiddleston Azets Publisher. Currently there are four rates of CGT between 10 and 28.

We were anticipating changes to the Capital Gains Tax CGT rates due to the Office of Tax Simplification report from last year so it was good news to hear that the regime remains unchanged going into the 202122 UK tax year. Once again no change to CGT rates was announced which actually came as no surprise. Proposed changes to Capital Gains Tax Current CGT rate Proposed CGT rate.

Bloomsbury Professional Publication Date. The rate of capital gains tax you pay remains the same but the extended window gives you. In accordance with the new changes if a person has died on or after 1 January this year only the value of their estate needs to be reported when applying for a probate.

You previously had 30 days to report any gains made from the sale and pay the tax you owed to HMRC. It is thought that income tax rates will be raised to 45 and it is likely the capital gains tax rate will increase to match it. The Office of Tax Simplification OTS announced a few weeks ago a review into capital gains tax CGT and that it would be reporting back to the government on a number of suggestions as to how to restructure the current CGT regime.

Capital Gains Tax UK changes are coming. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. 20 on assets 28 on property.

Each year at the moment there is a personal capital gains tax allowance. In 2021 the government implemented changes to the inheritance tax nil-rate band saying that. Taxes united-kingdom capital-gains-tax capital-gain.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. 20 on assets and property. The second part of the report is due in 2021.

Clark Apr 29 2021. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and CGT reform.

Capital gains tax allowance frozen. There was the Budget announcement delivered on 3 March together with the Finance Bill 2021 published on 11 March setting out medium-term tax and spending plans as the UK economy emerges from the COVID-19. So for the first 12300 of capital gain you could take that money completely tax-free.

Landlords could be affected by extra changes being proposed to capital gains tax. UK Tax Change 2021. 20 on assets 28 on property.

Spring 2021 brought two key developments to the UK tax landscape. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

Corporation Tax Income Forecast Uk 2021 Statista

Client Feedback Is Important To Us Here Is One Of The Feedback That We Have Received From A Client Clientfeedback Ht Accounting And Finance Finance Feelings

Capital Gains Tax Receipts Uk 2022 Statista

Rishi Sunak Shelves Proposal To Hike Capital Gains Tax Pointing To Burden The Independent

The Future Of Tax Legal Embracing Change With Confidence Accounting Accounting Course Financial Accounting

Union Budget 2019 20 Budgeting Inspiring Business Community Business

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

British Consumers Started The Big Splurge Real Time Data Show In 2021 Online Jobs Job Website Job Posting

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Nigeria Launches Enaira Amid Hope Skepticism And Plenty Of Uncertainty In 2021 Nigeria Financial Institutions Tough

The Beginner S Guide To The Stock Market Udemy Stock Market Investing Investing Investing In Stocks

What Kind Of Business Insurance Do You Require Call Accountants Uk Business Insurance Business Insurance

Client Feedback Is Important To Us Here Is One Of The Feedback That We Have Received From A Client Clientfeedback Ht Accounting And Finance Finance Feelings

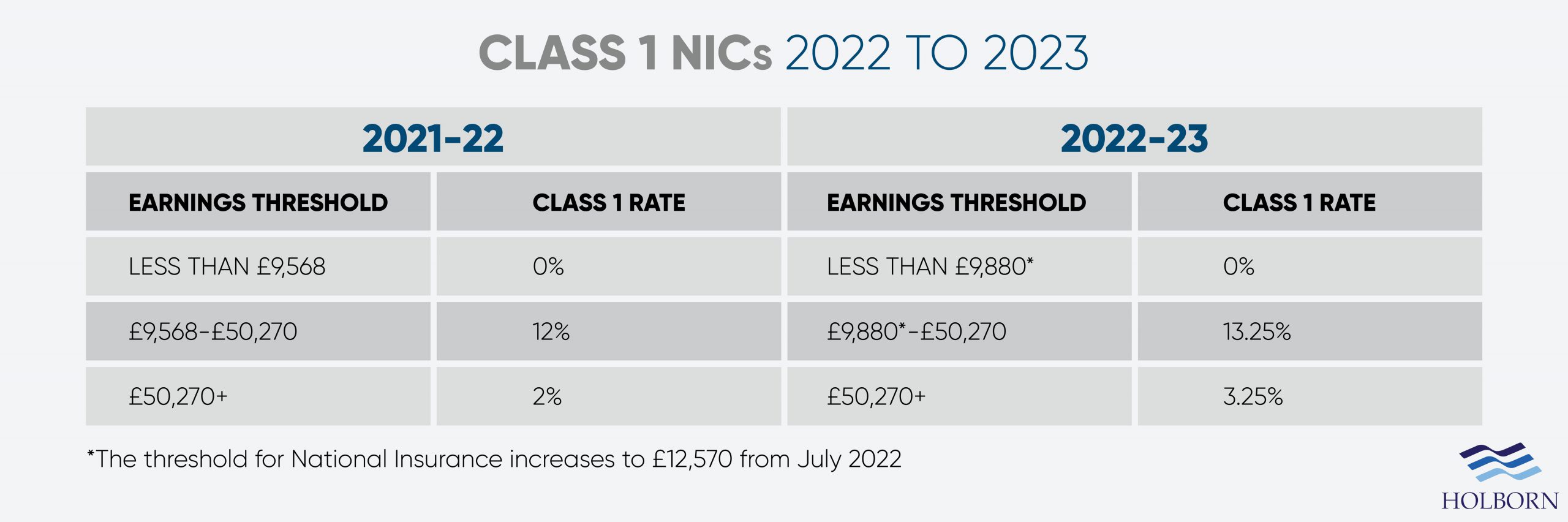

Changes To Uk Tax In 2022 Holborn Assets

A Guide For Young Investors Mutual Funds And Etfs In 2021 Stock Index Investing Online Trading

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Family Trust Understanding The Basics Family Trust Revocable Trust Trust